Rye’s Apawamis Gets Prop Taxes Slashed & $900K Refund Including $328K from Rye City Schools

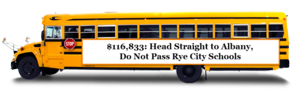

Rye City Schools are in the hole $328K.

(PHOTO: Apawamis just scored a $900K tax refund, and $328K is coming from Rye City Schools.)

And members of Rye's Apawamis Club, the elite private golf course and squash mecca, are feeling like they just hit a hole in one.

The Club won a tax fight with Rye City and Harrison, the result of which is a refund of $900K and a 50% reduction in its taxes to $200K. Rye City Schools will pick up $328K of the tab.

The full story from LoHud.com:

"It’s party time at the Apawamis Club in Rye, one of Westchester County’s premier golf and racquet clubs.

The club where George and Barbara Bush had their wedding reception in 1945, and teenage squash players today throng to one of the nation’s top youth squash programs, now has much more to celebrate.

This month, Apawamis club members can toast to their exclusive club’s victory over the city of Rye and town of Harrison in its recently settled property-assessment case, which will cut the club’s property taxes roughly in half — to about $200,000 a year.

Not bad for a club with assets of $46 million and legendary squash coach Peter Briggs, of Pound Ridge, who earned $442,000 at Apawamis in 2014, according to the club's 2014 IRS filing.

Refunds estimated by Tax Watch at $900,000 are due the private, nonprofit club, which in 2014, reported gross receipts of $15 million…

The consent judgments with Rye and Harrison, approved by state Supreme Court Justice Bruce Tolbert on Jan. 4, are the most recent windfalls for private country clubs in the lower Hudson Valley, which routinely challenge the taxable value of their verdant fairways and lavish clubhouses.

(PHOTO: The pool at Apawamis.)

They regularly win, thanks in part to state Supreme Court decisions that require local assessors to value the club’s property as if they were municipal courses, without considering what members pay in dues and initiation fees to have access to the greens, courts, and its 120-seat 19th hole….

A 2012 job posting for the Apawamis Club’s general manager, and its 2014 IRS report, provide a glimpse into the club's financial well-being. The club's 990 report is public because as a private social club, the nonprofit organization doesn't pay federal taxes on its income. Other nonprofits, such as schools and churches, which are considered nonprofit charities, are also exempt from paying property taxes.

The job posting for the Apawamis general manager’s job from GSI Executive Search touted the club’s annual dues of $11,200, which would be paid after new members paid an initiation fee of $69,500. Based on Apawamis’ 2014 IRS report, and its 2012 rate, the club would have about 550 members today.

Apawamis General Manager Rory Godfrey, who earned $301,000 in 2014, declined comment. Other Apawamis employees include Course Superintendent William Perlee at $222,000; golf pro James Ondo at $205,000; and as previously mentioned, squash pro Briggs. Briggs is the region’s squash guru, whose youth program at the club’s seven courts has sent dozens of local squash players to top colleges around the country…

The tax case’s biggest impact will come to the Harrison and Rye City schools, which comprise the biggest chunk of local tax bills. The decision rejiggered the assessments dating back to 2010, so refunds are due, based on the lower values.

The Rye City schools owe Apawamis $328,000. The payment was taken from the district’s 2015-16 surplus, said Rye Superintendent Brian Monahan."

See the rest at LoHud.com

A bigger question I believe is – how in the world did this assessment get applied to the Apawamis Club to begin with? Secondly, why did the city not force the club into the court system where the 2nd Department Court of Appeals has ruled repeatedly against both resident homeowners and other municipalities (Town of Rye) in favor of Rye City for years? And 3rd, why has this news broken without warning and no mention of this possible loss been posted to the city’s weekly litigation updates?

The answer I’m afraid is – the city could not risk yet another simultaneous documentary discovery of yet another selective reassessment by Rye City Assessor Noreen Whitty and Rye Corporation Counsel Kristen Wilson.

My own property tax case which the city forced upon me is I believe instructive – and its dates overlapping. In it the evidence accumulated at trial by the Supreme Court found Rye had no reasonable methodology for the assessment amounts it made up – just as they did to Apawamis starting in 2010. Here’s a flavor of that inequity from my own NYS Supreme Court ruling in November 2012 –

“Thus, while Whitty may have explained her reasoning for the assessment changes, namely that there were improvements, she wholly failed to justify those changes, as required. Her changes do not appear, from her testimony, to have been based on objective data; they do not appear to have been calculated based on an accepted approach or methodology; she appears to have consulted no manuals, tables, or any other authorities on costing; and, most importantly, whatever basis she used for her conclusions, it did not appear in an “…equitable, comprehensive, written plan directed to the revaluation of all of the properties in the Town.” Leone, supra. Consequently, having failed in its burden to explain and justify the 2003 and 2004 reassessments in the instant matter, namely the increase in the assessed value in 2003 to $103,700, over the 2002 value, and the increase in assessed value in 2004 to $120,020 over the 2003 value, respondent’s actions are found to have constituted selective reassessment of the subject premises.”

Ex-Rye Deputy Mayor and attorney Laura Brett publicly insisted my case HAD to be brought to the 2nd Department and therein tried to the upmost. Councilwoman Brett and the rest of the city council of that era (including now Mayor Joe Sack) were obviously aware that my 2012 Supreme Court ruling would impact the standing of the new 2010 Apawamis assessment and many others. They had to buy time and hope the 2nd Department would toss out my judgment. It did in late 2014. Yet this Apawamis matter – unlike my simultaneous case – was ticking along the whole time and was kept out of public view.

And now the big bang from Apawamis is here, clobbering taxpayers unexpectedly. And the golfers never even had to go to court and testify. How very special, and very selective.

Dear tedc,

Great analysis. This Rye City Council is useless and clueless.

BTW I go to bed at night resting easy knowing that Councilwoman Epstein is taking such a strong stance on swastikas being painted on walls in Chicago or wherever. Im guessing it’s probably to deflect from Rye’s ongoing corruption and her ignoring it.

And – word of yet another six-figure settlement against the city assessor has just reached us. Seems like this was an unsustainable planned strategy of selective ambush assessments now unraveling. Developing.

Ted,

i find it amazing that Councilwoman Bucci says the only expenses the city council can control is retiree health care costs. She must be an idiot because she and the other members of the city council are throwing our tax dollars away with these tax settlements.

What about the $1,000,000+ in legal fees in 2016 that was $500,000+ over budget?

Waters Edge is getting a $275,000 refund and a $75,000 annual tax assessment decrease going forward.

Why is Rye Corporation Counsel Kristen Wilson’s former law firm Harris Beach the attorney of record on the settlement?

Did Harris Beach and/or Wilson receive outside legal fees for this?

Is there some kind of quid pro quo in place?

Sack should stop conducting City of Rye business behind closed doors in executive session.